Economic wrap-up for June 2025

June was a busy month for Stats SA’s publication schedule, with 28 releases published in the month.

Lacklustre economic growth in the first quarter

June began with the release of the latest gross domestic product (GDP) estimates, for the first quarter (January–March) of 2025. GDP expanded by a muted 0,1%, with agriculture leading the increase. Transport, trade and finance also recorded positive gains on the supply (production) side of the economy. All other industries contracted, with mining and manufacturing the most noteworthy drags on growth.

Consumer spending remained buoyant on the demand (expenditure) side of the economy, with household consumption recording a fourth consecutive quarter of growth. A drawdown in inventories and a rise in exports also contributed to the improvement. However, increased imports, weaker government spending and lower infrastructure investment dampened overall growth.

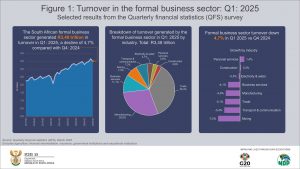

Formal business turnover declines in the first three months

The first quarter of the year is characteristically quieter for the formal business sector. Total turnover decreased by 4,7% in the first quarter of 2025 compared with the fourth quarter of 2024, according to the latest Quarterly financial statistics (QFS) survey (Figure 1). Six of the eight QFS industries contracted, with personal services and construction the only positive contributors.

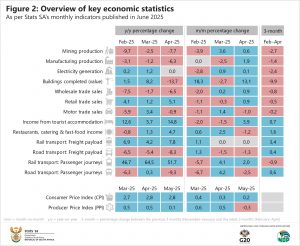

Economic performance in April

The latest monthly business indicators provide an overview of economic performance for the first month of the second quarter. On a year-on-year basis, mining, manufacturing, construction (buildings completed as reported by large municipalities), wholesale trade, motor trade, and road transport (both freight and passenger) were down in April. Electricity generation was flat (Figure 2).

Mining production decreased by 7,7% year-on-year. On the positive side, diamonds, iron ore, chromium ore and manganese ore recorded gains, but this was not enough to offset the downward pressure exerted by platinum group metals, nickel, copper, gold and coal.

Manufacturing output also disappointed. Declines were recorded across the board, with nine of the ten manufacturing divisions witnessing a slowdown in activity. Glass & non-metallic mineral products was the only division that recorded a positive month.

Consumer spending was stronger in April, with retail trade recording the fourteenth consecutive month of positive year-on-year growth. General dealers (which includes supermarkets) and retailers in textiles & clothing drove most of the upward momentum. Six of the seven retail groups recorded growth. Hardware, paint & glass was the lone exception.

Other notable releases published in June

- Agricultural industry, 2023: Based on a large sample of farmers registered for value-added tax (VAT), this survey collected financial, production and employment data for the commercial agricultural industry. The report, Excel files and media presentation are available here.

- Financial statistics of national government, 2023/2024: This annual statistical release provides a financial overview of national government. The official release can be accessed here. A guide on how to read and interpret the two key summary tables is available here.

- Financial statistics of municipalities for the year ended 30 June 2024: Published once a year, this dataset provides financial data for all 257 municipalities, available here in Excel.

- Quarterly capital expenditure (QCE): This covers data on the acquisition of new assets in the formal business sector. Download the release here.

- Quarterly Employment Statistics (QES): This data provides the latest employment figures from the formal business sector. Read an overview of the figures here.

Interested to know more?

Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For regular updates of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.