GDP growth subdued in the first quarter

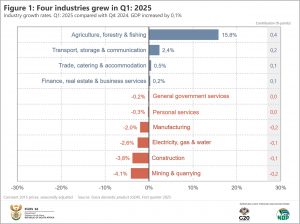

The South African economy kept its head above water in the first quarter of 2025 (January–March), expanding by a marginal 0,1% compared with the fourth quarter of 2024.1 Four of the ten industries on the production (supply) side of the economy recorded positive gains, with agriculture driving most of the upward momentum. Household spending, stronger exports and a drawdown in inventories kept the expenditure (demand) side of the economy in positive territory.

Agriculture keeps the economy afloat

Agriculture production increased by 15,8%, adding 0,4 of a percentage point to gross domestic product (GDP) growth (Figure 1). Good rains contributed to the industry’s fortunes, with horticulture benefitting the most. Animal products also fared well.

Without the boost from agriculture, GDP would have contracted by 0,3%.

Transport, storage & communication was the second-largest positive contributor, with gains recorded in land transport, air transport and transport support services.

Consumer activity was stronger, with trade, catering & accommodation expanding by 0,5%. Retail trade, motor trade, accommodation and food & beverages contributed positively.

Mining and manufacturing were the biggest drags in the first quarter. Together, both industries shaved 0,4 of a percentage point off GDP growth. Mining weakened by 4,1%, with platinum group metals the most significant negative contributor. Coal, chromium ore, gold, copper and nickel also disappointed. Iron ore, manganese ore and diamonds recorded gains, but not enough to lift the industry into positive territory.

Manufacturing activity slowed on the back of weaker production levels for petroleum & chemicals, food & beverages, and motor vehicles & other transport equipment. Only three of the ten manufacturing divisions experienced a favourable quarter, according to the latest monthly manufacturing release.2 These included textiles & clothing; wood, paper & publishing; and radio, television & communication & professional equipment.

After a 310-day hiatus, load shedding returned in the first quarter.3 This contributed to a 2,6% decline in electricity, gas & water, the largest contraction since the third quarter of 2022 (-2,8%). Water consumption was also down, adding to the industry’s poor showing.

Growth in expenditure on GDP also muted

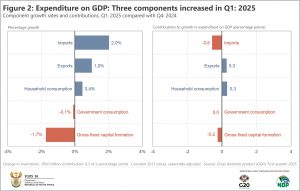

The expenditure side of the economy was also marginally positive, growing by 0,1% in the first quarter of 2025 compared with the fourth quarter of 2024. A drawdown in inventories, exports and household consumption contributed positively, while imports, gross fixed capital formation and government consumption weighed negatively on growth (Figure 2).

The R9,0 billion drawdown in inventories occurred across several industries, including transport, storage & communication; trade, catering & accommodation; manufacturing; finance, real estate & business services; and personal services. This represents the fifth consecutive quarter of inventory drawdowns in the economy.

Exports expanded for a second straight quarter, rising by 1,0%. Vegetables, vehicles & transport equipment (excluding large aircraft) and mineral products underpinned the increase.

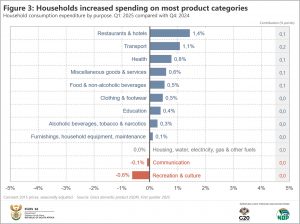

Household consumption expanded for a fourth consecutive quarter, buoyed by a rise in spending on transport (particularly, on vehicles), food & non-alcoholic beverages, restaurants & hotels, miscellaneous goods & services, and health. However, households cut back on recreation & culture and communication (Figure 3).

Returning to Figure 2, gross fixed capital formation (which includes infrastructure development and investment in fixed assets) declined by 1,7%. There was a slowdown in economic activity related to residential buildings and construction works. Investments in machinery & other equipment and transport equipment were also weaker.

Imports increased by 2,0% in the first quarter, contributing negatively to economic growth. The rise was driven mainly by stronger demand for chemical products, mineral products and machinery & electrical equipment.

For more information, download the latest GDP release, media presentation and Excel files here.

1 The quarter-on-quarter rates are seasonally adjusted and in real (volume) terms (constant 2015 prices).

2 Stats SA, Manufacturing: Production and sales, March 2025. Table B (download here).

3 Data on loadshedding is available from The Outlier, in partnership with EskomSePush (access here).