Economic wrap-up for October 2025

Stats SA published 23 statistical releases in October 2025. Notable economic outputs include data on public-sector infrastructure investment, and financial figures for higher education institutions.

Public-sector capital spending is on a three-year upswing

The 748 institutions that comprise South Africa’s public sector injected R276 billion into infrastructure projects in 2024, raising capital expenditure for a third consecutive year. The sector focused primarily on the development and maintenance of roads, railways and the electricity grid, with Eskom, the Passenger Rail Agency of South Africa, Transnet and the South African National Roads Agency listed as the biggest spenders.

Despite this increase, public-sector capital expenditure remains below the 2016 peak of R283 billion.

Tertiary education was also in the spotlight in October 2025, with Stats SA releasing the latest financial data for this sector. The country’s 20 universities and six universities of technology generated R112 billion in revenue during 2024, with 41% coming from government, 39% from tuition fees and 20% from other sources. Expenses amounted to R97 billion. Compensation of employees was the most significant cost driver, accounting for 60% of the total figure.

The latest economic data

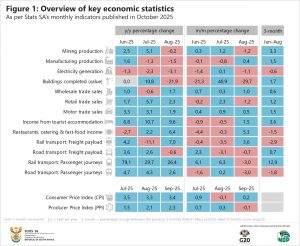

Stats SA’s latest round of monthly indicators covers August 2025. Year-on-year growth rates were mainly positive, except for mining, manufacturing, electricity generation, construction (buildings reported as completed by larger municipalities) and road freight transport (Figure 1).

South Africa’s mining production shrank by 0,2%, with platinum group metals exerting most of the downward pressure. Nickel, copper, gold, manganese and chromium ores were also negative. On the positive side, the industry produced more diamonds, coal and iron ore.

Manufacturing output was also lacklustre, weakening by 1,5% year-on-year. Four divisions performed poorly in August 2025. A sharp decline in metals and machinery production was the main drag on overall growth. Six divisions grew, but not enough to lift the manufacturing industry into positive territory. Automotive and transport equipment manufacturing registered the highest growth rate, expanding by 4,7% year-on-year.

Consumer spending remained upbeat, with retail trade recording its 18th consecutive month of positive year-on-year growth. Six of the seven retail groups lifted overall sales by 2,3%, with the miscellaneous category referred to as ‘all other retailers’, the main driver of growth. This category includes online stores and retailers specialising in jewellery, stationery and sports goods. Food & beverages in specialised stores was the only retail group that performed poorly in August 2025, marking a fourth consecutive month of year-on-year decline.

Motor trade was also positive, rising by 1,9%. New vehicle sales drove much of the upward momentum, supported by a rise in the sales of accessories.

Fuel sales, convenience store sales, workshop income and used vehicle sales were down, but not enough to spoil the motor trade’s overall performance.

Interested to know more? Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.