What do we know about the finances of gambling boards?

Recently, Stats SA explored the latest data on gambling and betting activity in South Africa.1 Further to this, another set of data provides a high-level financial overview of institutions tasked with regulating the industry.

Stats SA’s Financial statistics of extra-budgetary accounts and funds statistical release focuses on cash flow data for 260 public institutions referred to as extra-budgetary accounts and funds (EBAs).2 These institutions provide important services to the public on behalf of government. Examples include the Road Accident Fund, National Student Financial Aid Scheme, South African Revenue Service, and the South African Social Security Agency. The National Gambling Board of South Africa and the nine provincial gambling boards are also classified as EBAs.

South Africa’s gambling sector is regulated through a three-tier governance structure. The Department of Trade, Industry and Competition sets national gambling policies and standards. The National Gambling Board oversees compliance, advises on policy, and conducts research into the socio-economic impact of gambling and betting activities.

At provincial level, the nine provincial gambling boards manage licensing, monitor compliance with gambling laws, enforce regulations through penalties and ensure adherence to related legislation. Together, these bodies work to maintain a balanced and well-regulated gambling industry.3

As EBAs, the gambling boards’ finances operate outside the core parliamentary appropriation process. However, they remain subject to public audit.

Sources of revenue

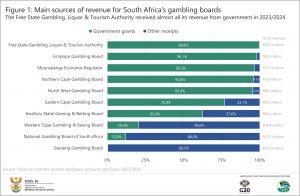

Revenue streams are classified into government grants and other receipts (Figure 1). Government grants should not be confused with social grants. Government grants in this context refer to financial transfers from the national government.

Most gambling boards heavily depend on the government for revenue. In 2024, the Free State Gambling, Liquor & Tourism Authority received almost all its revenue from government grants, with a marginal amount from other sources. On the other end of the spectrum, other receipts accounted for the bulk of revenue for the Gauteng Gambling Board. Other receipts include revenue such as licence fees, penalties collected and gambling levies.4 For the Gauteng Gambling Board, a collection commission was a major source of revenue. This is a portion of gambling taxes that the Board retains as compensation for administering collections on behalf of the provincial government.5

The National Gambling Board also receives most of its revenue from other sources. Fees collected from limited payout machine (LPM) operators form a large part of the Board’s revenue. LPMs are gambling machines found in clubs, taverns and pubs. They are similar to gambling machines in casinos but differ in that they offer limited cash payouts. LPM fees are collected by a National Central Electronic Monitoring System (NCEMS) operator on behalf of the National Gambling Board.6

Spending patterns

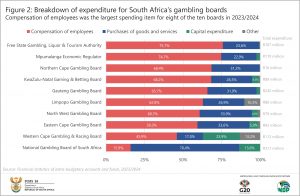

The expenditure structure of the ten gambling boards reveals priorities in compensation of employees, purchases of goods and services and capital expenditure.

Compensation of employees is a major cost driver, accounting for over half of total expenditure in eight of the ten gambling boards (Figure 2).

The National Gambling Board spent 70,4% of its budget on purchases of goods and services. This was mainly due to an amount of R197 million paid to the NCEMS operator for collecting LPM fees.7 The Western Cape Gambling & Racing Board recorded the highest percentage on capital expenditure.

Download the Financial statistics of extra-budgetary accounts and funds statistical release for 2023/2024 here.

1 Stats SA. Appetite for gambling and betting grows (read here).

2 The EBA statistical release is one of several government financial releases published by Stats SA. Recent releases include financial data for national government, local government and provincial government. Data for higher education institutions will be published in October. A consolidated release, which incorporates data from all these releases, will be available in November.

3 Department of Trade and Industry. Gambling in South Africa (download here).

4 Note that gambling and betting taxes collected by gambling boards are not included in the EBA statistical release. The boards collect taxes on behalf of provincial government. In context of the 2014 Government Finance Statistics Manual (GFSM), provincial government is thus regarded as the primary entity involved in these transactions. As such, gambling and betting taxes collected by the gambling boards are recorded in provincial government financial statistics. In 2022/2023, provincial government received R4 billion in gambling and betting taxes from various sources, including from the gambling boards.

5 Gauteng Gambling Board. Annual Report 2023/2024, page 135 (download here).

6 National Gambling Board of South Africa. Annual Report 2023/24, pages 24 and 97 (download here).

7 National Gambling Board of South Africa. Annual Report 2023/24, page 69 (download here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.