Economic wrap-up for May 2025

Stats SA published 23 statistical releases in May, several providing a preliminary overview of economic performance in the first quarter. Other notable outputs in the month include the latest inflation and unemployment figures.

Business performance in the quarter

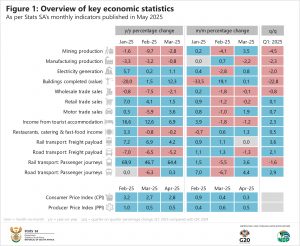

The monthly business data conclude the results for the first quarter of the calendar year. Mining, manufacturing, electricity generation, construction (buildings reported as completed by large municipalities), wholesale trade, and rail passenger transport weakened in the first quarter (Figure 1).

Mining was down by 4,5%, with platinum group metals the most noteworthy drag on overall growth. Nickel, copper, chromium ore, coal and gold also performed poorly. Iron ore, manganese ore and diamonds were positive.

The manufacturing industry shrank by 2,3%, with seven of the ten manufacturing divisions recording negative growth rates. The most significant downward pressure came from petroleum & chemical products, food & beverages and motor vehicles & other transport equipment.

The value of buildings completed retreated by 22,8%. The completion of non-residential buildings witnessed the largest decrease (-47,9%), followed by additions & alterations (-32,2%) and residential buildings (-4,2%).1 January was particularly rough, with notable monthly declines across all three categories. Residential buildings and additions & alterations showed some recovery in February and March, but not enough to lift their quarterly growth rates into positive territory. Non-residential buildings disappointed throughout the quarter, recording three consecutive months of decline.

There were several bright spots in the first quarter. Retail trade; motor trade; tourist accommodation; restaurants, catering & fast-food; rail and road freight transport; and road passenger transport registered positive growth rates.

New and used vehicle sales lifted motor trade by 0,7%. New vehicle sales provided much of the upward momentum, growing by 4,6%. Declines were recorded for fuel sales, sales of accessories, convenience store sales and workshop income.

Consumer spending was marginally better, with retail trade sales edging higher by 0,1%. Six of the seven retail groups experienced a positive quarter, with hardware, paint & glass recording the highest growth rate (+1,7%). General dealers, which includes supermarkets, shrank by 0,6%.

Fuel prices drift lower, while beef heats up

The latest consumer price data show fuel prices declining on average by 3,2% between March and April. Although motorists are paying 13,4% less for fuel than a year ago, prices remain above pre-pandemic levels. For example, a litre of 95-octane petrol was R21,62 in April 2025, down from a peak of R26,74 in July 2022, but still much higher than the dip of R12,22 in May 20202 (Figure 2).

Annual inflation for food & non-alcoholic beverages rose sharply to 4,0% in April from 2,7% in March. This was mainly because of higher meat prices, particularly for beef products.

Youth caught in the grip of unemployment

On the labour front, South Africa’s official unemployment rate rose to 32,9% in the first quarter of 2025. This is the highest rate since the second quarter of 2024 (33,5%). Job losses were recorded in five of the ten industries, including trade, construction, private households, community & social services and mining.

The youth unemployment rate rose to 46,1%. Of the 10,5 million people aged 15–34 who were available and willing to work in the first quarter, 4,8 million were unemployed. The youth unemployment rate has stubbornly remained above the 40% mark since the third quarter of 2020, peaking at 49,3% in the middle of 2021. This article provides an overview of the current state of youth unemployment in South Africa.

Notable releases in June

Additional labour data, for the formal business sector, will be released on 24 June. The next gross domestic product (GDP) estimates will be released on 3 June, providing a comprehensive overview of economic performance in the first quarter. Other key releases in June include quarterly financial statistics for the formal business sector (26 June); annual and quarterly financial data for municipalities (26 June); and national government financial statistics (26 June).

Interested to know more?

Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.

1 Seasonally adjusted. See Table 8 in the release.

2 Department of Mineral Resources and Energy. Comparing prices for petrol, diesel and illuminating paraffin (IP) (click here).