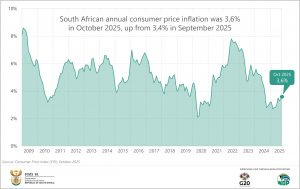

Inflation climbs for a second consecutive month

Annual consumer inflation rose to 3,6% in October from 3,4% in September. This is the highest inflation print since September 2024 when the rate was 3,8%. The consumer price index (CPI) increased by 0,1% month-on-month in October 2025.

The transport; recreation, sport & culture; and alcoholic beverages & tobacco categories recorded hotter annual rates. Inflation cooled for several categories, most notably restaurants & accommodation services and food & non-alcoholic beverages (NAB).

Food inflation dips further

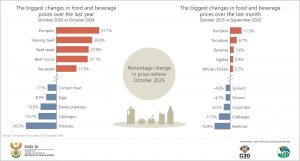

Annual inflation for food & NAB weakened to 3,9% from 4,5% in September. Several food & NAB categories witnessed a slowdown, including vegetables; fruits & nuts; cold & hot beverages; sugar, confectionery & desserts; and meat. Categories that recorded faster price growth include cereal products; fish & other seafood; oils & fats; milk, other dairy products & eggs; and the miscellaneous group ‘other food’.

Meat inflation retreated from its highest level in almost eight years, moderating to 11,4% from 11,7% in September. Despite the lower reading, several meat products remain in double-digit territory, including stewing beef (30,9%), beef steak (27,9%), beef mince (27,1%), sausages (17,3%), boerewors (15,6%) and mutton (13,4%).

Not all was bad news on the meat front, however. Corned meat, fresh whole chicken and bacon are cheaper than a year ago. The average price for 200 grams of bacon, for example, declined from R41,25 to R41,11 over this period.

Inflation for sugar, confectionery & desserts slowed to 3,5%, the lowest since March 2022 (3,4%). White and brown sugar, jam, peanut butter, and chocolate recorded lower rates.

Hot beverage inflation dipped to 8,8%, its weakest level since August 2023 (6,3%). In October, softer rates were recorded for black tea (5,1%), rooibos tea (1,6%) and cappuccino sachets (1,4%).

The annual rate for cereal products rose to 2,0% from 1,6% in September. Samp and maize meal recorded double-digit inflation in October, with maize meal reaching a four-month high at 10,7%. Several products cost less than a year ago, including white rice, brown bread, hot cereals and instant noodles.

Although it is in deflationary territory, the milk, other dairy products & eggs category witnessed a rise from -1,6% in September to -1,5% in October. A range of products carry a cheaper price tag than they did in the same month last year, including eggs, maize-based food drinks and several varieties of milk.

The graph below shows the food and beverage products that recorded the sharpest price increases and decreases in October.

Other notable price changes

The annual rate for transport turned positive following 13 months of deflation, rising from ‑0,1% in September to 1,5% in October. Fuel prices increased by 0,1% between September and October, with diesel declining by 0,7% and petrol rising by 0,2%. This took the annual rate for fuel to 3,3%, the first positive reading since August 2024.

The index for recreation, sport & culture increased to 3,4% from 2,9% in September. The top 10 books sold across several retailers recorded an annual inflation rate of 59,4%. Movie tickets increased by 15,8% and gym fees by 10,5% in the 12 months to October. However, ticket prices for sporting events declined by 12,6% over the same period.

Stats SA publishes inflation rates for each province and for different expenditure bands. The province with the highest inflation rate in October was North West at 4,3%, and the lowest was Eastern Cape at 3,1%. While the poorest typically experience higher inflation rates, in October the richest recorded the highest rate at 3,9%.

For more information, download the October 2025 CPI statistical release and associated Excel files with indices and average prices here.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.