The economy expands by 0,8% in the second quarter

Following marginal growth of 0,1% in the first quarter of 2025, real gross domestic product (GDP) strengthened by 0,8%1 in the second quarter (April–June). Manufacturing, mining and trade led growth on the production (supply) side of the economy. The expenditure (demand) side was also positive, lifted mainly by stronger household consumption and softer imports.

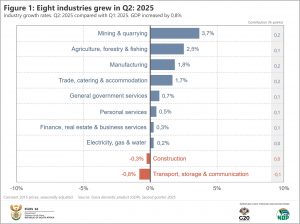

Eight industries record gains

Manufacturing; mining & quarrying; and trade, catering & accommodation were the most significant positive contributors in the second quarter, each adding 0,2 of a percentage point to GDP growth (Figure 1).

After two consecutive quarters of decline, manufacturing and mining turned positive. Manufacturing production expanded by 1,8%, driven mainly by the automotive and petroleum, chemicals, rubber & plastics divisions. Mining output grew by 3,7%, the fastest pace since the first quarter of 2021 (4,4%). Platinum group metals, gold and chromium ore were the main positive contributors.

Consumer activity was upbeat. The trade, catering & accommodation industry increased by 1,7%, its strongest showing since the first quarter of 2022 (2,6%). Retail trade, motor trade, accommodation, and food & beverages recorded gains. Wholesale trade was the exception, registering a dip in the second quarter.

Agriculture carried over some of its positive momentum, recording a third consecutive increase. The industry grew by 2,5%, following a revised 18,6% rise in the first quarter. This was primarily due to increased economic activity reported for horticulture and animal products.

Construction and transport, storage & communication disappointed in the second quarter. The construction industry witnessed its third consecutive decline, pulled lower by weaker economic activity related to residential and non-residential buildings. There was a rise in construction works, but this was not enough to lift the industry into positive territory. Land transport and transport support services had a negative impact on growth in the transport, storage & communication industry.

Household consumption continues to rise

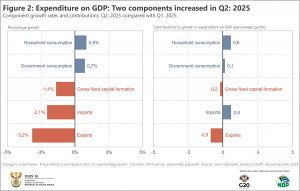

Household consumption and imports were the most significant positive contributors to growth on the expenditure (demand) side of the economy. A decline in gross fixed capital formation and weaker exports contributed negatively (Figure 2).

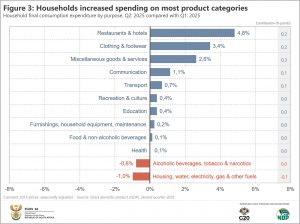

Household consumption increased for a fifth consecutive quarter, rising by 0,8%. The miscellaneous category was the most significant positive contributor, driven higher mainly by increased spending on insurance (which forms part of miscellaneous goods and services) (Figure 3).

Households also spent more on a variety of other products, most notably restaurants & hotels and clothing & footwear. On the downside, there was lower demand for alcoholic beverages, tobacco & narcotics, and housing, water, electricity, gas & other fuels.

After five consecutive inventory drawdowns in the South African economy, there was a build-up of R16,6 billion in the second quarter.2 The rise in inventories occurred across the mining & quarrying; transport, storage & communication; and manufacturing industries.

Imports declined by 2,1% (Figure 2), largely due to decreases in imported chemical products, machinery & electrical equipment, mineral products and vegetable products. Exports were also down, driven lower mainly by declines in exported base metals & articles of base metals, vegetable products, and vehicles & transport equipment (excluding large aircraft).

For more information, download the latest GDP release, media presentation and Excel files here.

1 The quarter-on-quarter rates are seasonally adjusted and in real (volume) terms (constant 2015 prices).

2 Inventory values are seasonally adjusted and annualised.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.