Advancing Gender Equality through Financial Inclusion

Women make up just over half of South Africa’s population, yet their ability to fully participate in the economy remains uneven. From securing credit to owning land, accessing finance as capital to finding opportunities in formal employment, barriers continue to limit women’s financial inclusion. The impact is most pronounced among women in rural communities, low-income households, and the informal sector—groups that carry the heaviest burden of exclusion.

This year marks three decades since the landmark Beijing Declaration, where nations pledged to advance gender equality. South Africa steps into the global spotlight as it assumes the G20 presidency under the theme “Solidarity, Equality, Sustainability.” These overlapping milestones sharpen the focus on women-centered financial reforms and policies.

Between 2014 and 2024, shifts in access to banking, credit, savings, insurance, and digital platforms show both progress and persistent gaps for women, whether as individuals or as owners of informal businesses. The question now is whether financial systems can evolve to build resilient economies that work for all—a goal at the heart of this year’s Women’s Month theme: “Building Resilient Economies for All.”

Digital Access narrows the gender divide

According to the Gender Series Volume XII: Financial Inclusion through A Gender Lens, 2024 released by Statistics South Africa (Stats SA), access to the internet has become a key driver of financial inclusion, and South Africa has seen notable progress over the past decade. Between 2014 and 2024, access to internet among female-headed households rose from 46,1% to 83,1%.

By 2024, mobile internet had emerged as the main form of access, used by 77,0% of female-headed households compared with 74,6% of male-headed ones. This progress not only reflects greater parity in internet access but also provides a strong foundation for expanding mobile and digital banking services across the country.

Gender gaps persist in access to financial services

Only 7,0% of women reported owning a credit card compared to 9,0% of men, while overdraft use stood at 13,0% for women against 18,0% for men. On the investment side, however, women were slightly ahead, with 46,0% reporting investments compared to 45,0% of men.

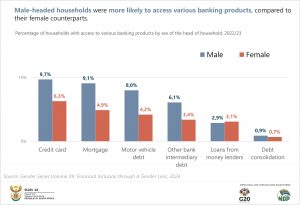

At a household level, male-headed households continued to hold the advantage in access to credit cards, with 9,7% having one compared to just 6,3% of female-headed households. This pattern was observed consistently across all provinces. Mortgages showed an even wider divide: 9,1% of male-headed households reported having a mortgage, nearly double the 4,9% recorded for female-headed households. In urban areas, the disparity was greater at 5,1 percentage points, while in non-urban areas the difference was minimal at 0,2 percentage points.

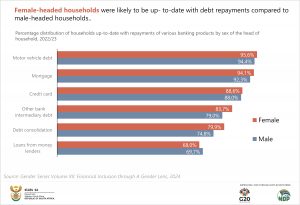

Despite these disparities, female-headed households demonstrated stronger housing security, being more likely to live in fully paid homes. They also showed slightly higher levels of financial responsibility, with a greater likelihood of staying on time with repayments of credit cards, debt consolidation and other bank debt compared to their male counterparts.

Informal finance and business: women making gains, but barriers remain

Despite progress in digital connectivity and entrepreneurship, informal credit and business practices continue to shape South Africa’s financial landscape. In 2024, 3,1% of female-headed households and 2,9% of male-headed households reported using money lenders. Age, however, played a decisive role in borrowing behaviour: young male-headed households (15–34) relied far more on informal loans, with usage 14,5 percentage points higher than their female counterparts. Among older persons (60+), the pattern reversed — female-headed households were 13,3 percentage points more likely to use money lenders.

The informal business sector, a crucial part of the economy, has seen gradual shifts toward gender inclusivity. Female ownership of informal enterprises grew from 40,4% in 2017 to 42,3% in 2023. However, access to formal banking remains elusive: more than 74% of informal businesses had no formal banking access in 2023. Only 26,2% of male and 22,3% of female owners held bank accounts, highlighting persistent financial exclusion.

Payment methods have also shifted. Between 2017 and 2023, debit card and Paycash use declined among women (from 81,5% to 65,0%) and men (80,5% to 67,2%). In contrast, digital banking surged, with women showing greater uptake: internet and mobile banking use grew from 4,3% to 11,8% among female entrepreneurs compared with 4,5% to 10,1% for men. This signals a steady pivot toward digital payments, particularly among women.

Funding, however, remains a stumbling block. In 2023, only 4,9% of female informal business owners received formal start-up financing, far behind the 12,7% of male owners. Most women still rely on personal savings or informal loans from friends and family to keep businesses afloat.

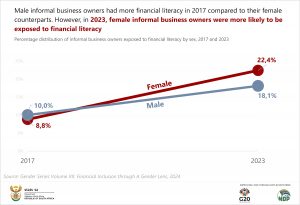

Notably, women’s financial literacy improved by 13,6 percentage points between 2017 and 2023. However, nearly one in five female business owners still lack formal financial education, pointing to the urgent need for targeted, inclusive training programmes that can help close the gender gap in entrepreneurship.

Financial inclusion goes beyond mere access to banking and credit; it is a vital tool for promoting equity and economic participation. Ensuring that women are fully engaged in South Africa’s financial system not only advances gender equality but also supports broader economic growth.

For more information, download the Gender Series Volume XII: Financial Inclusion through A Gender Lens, 2024 here.