Economic wrap-up for July 2025

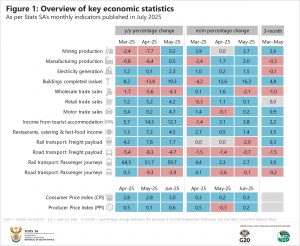

The latest set of monthly economic data is mainly positive, with several indicators strengthening on a year-on-year basis in May.

Consumer spending was stronger, with retail trade, motor trade, tourist accommodation and restaurants, catering & fast-food extending their gains. On the downside, wholesale trade, road freight transport and road passenger transport recorded a weaker month (Figure 1).

Delving deeper into the figures

Mining production was marginally positive, recording growth of 0,2% year-on-year. Iron ore led the increase, with help from nickel, diamonds, chromium ore, copper and gold. On the downside, manganese ore, coal and platinum group metals were weaker.

Manufacturing output turned positive in May after six consecutive months of year-on-year decline. Five of the ten manufacturing divisions recorded upward growth, with metals & machinery the largest positive contributor. Five manufacturing divisions were weaker, with the automotive division the largest drag on overall growth. Motor vehicle production was the main culprit, shrinking by 15,6% year-on-year.

In contrast to weaker automotive production, motor trade sales were upbeat. The 4,7% year-on-year rise in May was mainly driven by increased purchases of used vehicles, with positive support from sales of accessories, fuel sales and new vehicle purchases. Workshop income was down, but not enough to drag overall growth into negative territory.

Buoyant consumer activity also helped retail and restaurants, catering & fast-food. Retail continued to strengthen, recording its fifteenth consecutive month of positive year-on-year growth. Sales expanded by 4,2%, with textiles & clothing and general dealers the most significant positive contributors. Food & beverages was the only retail group that performed poorly in May.

Strong demand for fast-food, together with support from restaurants and catering services, kept the restaurants, catering & fast-food industry in positive territory.

Consumer inflation at 3,0%

Although headline inflation has cooled in the last year, inflationary risks remain. Food prices continue to be a concern, particularly for meat. Beef prices climbed notably for a third straight month in June, marked by sharp rises for stewing beef, mince and steak. Average price data highlight these increases. The average price per kilogram of stewing beef was R118,02 in June, up from R96,35 a year before. Beef rump steak increased to R194,09 from R160,50 per kilogram over the same period.1

Vegetable inflation was also higher, with notable price increases for beetroot, lettuce and carrots.

Not all was bad news. White rice, cereals, milk and eggs are cheaper than a year ago. Transport inflation also remains subdued, with fuel prices declining for a fourth consecutive month.

Factory gate inflation – a leading indicator of consumer inflation – was slightly higher in June, rising to 0,6% from 0,1% in May.

What to look forward to in August

Together with the monthly suite of indicators, August will also include the release of financial data for extra-budgetary accounts & funds (EBAs). EBAs form an important arm of government, delivering services to the public on behalf of government. Examples of EBAs include the National Gambling Board, the South African Revenue Service (SARS) and the South African National Roads Agency (SANRAL). The statistical report will be published here on 28 August.

Interested to find out what else will be released? Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For regular updates of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.

1 Average prices for 391 consumer products are available in Excel. Download the file here.