Tourism: the state of post-COVID-19 recovery

The economic fallout from COVID-19 affected many industries, including South Africa’s tourism sector. A decline in revenue from domestic (resident) visitors and inbound (non-resident) visitors, exacerbated by stringent travel restrictions, saw a fall in tourism trips, tourism-related expenditure, and employment.

The sector has shown signs of recovering from the pandemic’s repercussions. The latest Tourism Satellite Account for South Africa (TSA) report shows how the sector is faring; in terms of tourism expenditure, direct contribution to gross domestic product (GDP) and tourism direct employment.

Domestic tourism is recovering, but inbound and outbound are below pre-pandemic levels

Tourism expenditure represents money that domestic (resident) visitors and inbound (non-resident) visitors spend during their travels. The average visitor purchases a wide range of tourism products and services. Key examples include passenger transportation, accommodation, recreation and food. This money is a vital source of revenue, driving activity and growth within the tourism sector.

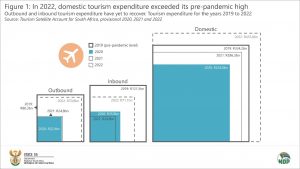

Figure 1 shows the total expenditure for 2019, 2020, 2021 and 2022, broken down by the type of tourism (inbound, outbound and domestic). What is immediately evident is the dominance of domestic tourism expenditure since 2019.1 Domestic visitors spent R435,8 billion in 2022. This represents a sharp rise from R286,3 billion in 2021 and is higher than the 2019 pre-pandemic value of R334,2 billion.

In other words, domestic tourism expenditure has recovered – and exceeded – its pre-pandemic level.

The same cannot be said for the other two forms of tourism. Inbound tourism expenditure represents money, often foreign currency, that non-resident visitors (same-day visitors and tourists) spend while in South Africa. In 2019, non-resident visitors spent R121,5 billion within the country’s borders. With the advent of the pandemic, this declined to R35,9 billion in 2020 and further weakened to R24,0 billion in 2021. There was a sharp recovery in 2022 to R71,1 billion, but not enough to reach pre-pandemic levels.

This rise in inbound tourism expenditure in 2022 aligns with travel data. The number of non-resident visitors gracing South African shores increased, from 2,7 million individuals in 2021 to 7,3 million in 2022. Despite this rise, the country still has a way to go to recover to the 2019 level of 14,8 million non-resident visitors.

Outbound tourism expenditure represents money South African residents take out of the country and spend on tourism goods and services of other countries when travelling abroad. Although there has been a consistent recovery in outbound tourism expenditure since 2020, it still fell short of its 2019 pre-pandemic level in 2022.

Tourism trade balance back in positive territory

Another noticeable aspect of Figure 1 is that inbound tourism expenditure was larger than outbound tourism expenditure in 2019. This represents a positive tourism trade balance (i.e. the country received more money via inbound tourism than it “lost” via outbound tourism). From 2005 to 2020, South Africa enjoyed a positive tourism trade balance with the rest of the world. However, in 2021, the country recorded its first (albeit small) negative trade balance, when outbound tourism expenditure exceeded inbound tourism expenditure.2

In 2022, the tourism trade balance flipped back into positive territory, although only by a small margin.

GDP contribution and employment are up but still below pre-pandemic levels

Two other important indicators from the TSA report include the tourism sector’s direct contribution to GDP and the number of people directly employed by the tourism sector. The sector directly contributed 3,5% to GDP in 2022, up from 2,3% in 2021 and 2,1% in 2020, but below the 2019 pre-pandemic contribution of 3,7%. In 2022, the tourism sector’s direct contribution to GDP was larger than three industries: construction, agriculture and utilities (electricity, gas & water supply).

There was a resurgence in employment after the pandemic. At 733 385 individuals, the direct tourism workforce in 2022 was much larger than in 2021 (492 561 individuals) but still below the pre-pandemic high of 777 686.

Are you interested to find out more? Download the Tourism Satellite Account for South Africa, provisional 2020, 2021 and 2022 statistical report here.

1 The sum of domestic and inbound tourism expenditure equals internal tourism expenditure (i.e. total tourism spending within the country by both non-resident and domestic visitors).

2 Stats SA, South Africa’s tourism trade balance entered negative territory in 2021 (read here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.