Economic wrap-up for October 2023

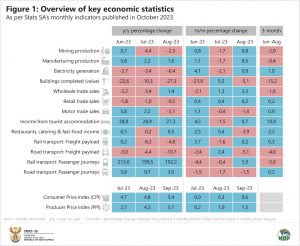

Stats SA published 25 statistical releases in October. Here is a quick overview of key economic indicators shaping the South African economy.

Consumer inflation rises for a second consecutive month

Inflation worries were stoked once again in September. The consumer price index (CPI), which reflects the changes in prices of a representative basket of goods and services that households buy, increased by 5,4% in September 2023 compared with September 2022. This is higher than the annual rates recorded in August (4,8%) and July (4,7%).

Fuel had a significant impact on the monthly rate. The transport index was responsible for two-thirds of the 0,6% rise in the cost of living between August 2023 and September 2023, mainly pushed higher by rising fuel prices.

Regarding food, the meat, fish, oils & fats and fruit items recorded higher annual inflation rates in September. Lower rates were recorded for bread & cereals, sugar, sweets & desserts, vegetables and milk, eggs & cheese.

Retail sales under pressure

South African consumers continued to cut back on spending in August, with retail trade sales recording its ninth consecutive month of year-on-year decline. Four of the seven retailer groups recorded weaker sales, with general dealers and hardware stores the major drags on growth. Consumers also shied away from retailers specialising in pharmaceuticals & cosmetics and household goods.

Not all was bad news on the retail front, however. Clothing stores and retailers in food & beverages registered a relatively good August, with the former recording a fourth consecutive month of positive year-on-year growth.

Mining and manufacturing

Mining output softened for a second consecutive month in August, contracting by 2,5% year-on-year (Figure 1). Diamonds, ‘other’ metallic minerals, building materials, manganese ore and coal were weaker. On the upside, copper, iron ore, platinum group metals, chromium ore, nickel and gold all recorded positive year-on-year results.

The manufacturing industry recorded its fifth consecutive month of year-on-year growth, increasing by 1,6% in August. Petroleum & chemicals and metals & machinery drove much of the upward momentum. Wood, paper & publishing and electrical machinery also registered positive results. Six divisions registered a decrease in production, with communication & professional equipment recording the sharpest year-on-year decline.

Public sector raises infrastructure investment

Public-sector capital expenditure increased in 2022, according to a survey of 748 institutions. The rise follows five consecutive years of capital expenditure decline in the public sector, particularly in 2020 and 2021 during the COVID-19 pandemic.

In 2022, the economy began to thaw with nationwide lockdowns ending for good. This allowed public-sector institutions to resume capital projects delayed by the pandemic. Eskom took the lead as the biggest spender in 2022, contributing R34 billion out of the total public-sector investment of R209 billion.

Despite the increase, public-sector capital expenditure remains below the 2019 mark of R230 billion, and below the all-time high of R283 billion recorded in 2016.

What to look forward to in November

Keep an eye on our publication schedule in November for three notable releases. First, Stats SA will publish the latest set of unemployment figures on 14 November, covering the third quarter of 2023. The report will be available here. Second, an annual release of financial data for the formal business sector, for 2022, will be published on 16 November (available here). Third, government finances will be in the spotlight on 30 November with Stats SA’s release of financial statistics for all spheres of government. This release will be available here.

Our publication schedule is available here. For a comprehensive list of products and releases, download our catalogue. For a regular update of economic indicators and infographics, visit our data story feed and catch the latest edition of the Stats Biz newsletter.