Economic wrap-up for May 2023

Stats SA published 21 statistical releases in the month of May, providing valuable insight into the current state of our economy. Here is a brief rundown of important indicators.

Inflation edged lower in April

Despite the ongoing stresses of rising prices and escalating costs of debt, there were some hopeful signs from the latest inflation data. Annual consumer inflation eased to an 11-month low in April, declining to 6,8% from 7,1% in March. Price increases for fuel, oils & fats and meat have lost steam, while upward inflationary pressure continues to haunt dairy products, vegetables and non-alcoholic beverages.

Inflation on the producer side slowed for a ninth straight month, slipping from 10,6% in March to 8,6% in April. The slowdown in inflation at the factory gate provides a trace of optimism, as producer price inflation often predicts future movements in the consumer price index.

Mining and manufacturing up in the quarter; electricity and motor trade down

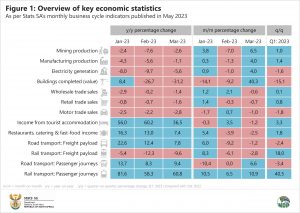

Stats SA’s monthly business cycle indicators published in May (Figure 1) conclude results for the first quarter (January‒March). Mining production strengthened in the quarter, rising by 1,0%. Gold, platinum group metals, iron ore, manganese and chromium lifted overall growth. On the downside, the country produced less nickel and copper. Nickel continued its poor run, recording a third consecutive quarter of decline.

Manufacturing output expanded by 1,4%, with four of the ten manufacturing divisions reporting increased production. Food & beverages was the largest positive contributor, driven mainly by the production of beverages. Motor vehicle parts & accessories and paper & paper products were the biggest drags on growth.

Textiles & clothing stores posted a strong quarter, driving most of the 0,8% rise in retail trade sales. Other retailers that registered positive results include those specialising in pharmaceuticals & cosmetics, food & beverages, and general dealers (i.e. supermarkets). On the negative side, consumers spent less on hardware, paint & glass and household goods. Retailers in hardware, paint & glass continue to feel pain, recording an eighth consecutive quarter of declining sales.

Electricity generation, construction (buildings completed), motor trade sales and road transportation were down in the quarter.

Unemployment rate inches higher

South Africa’s official unemployment rate increased slightly in the first quarter. There was a decline in the ‘not economically active’ population as individuals entered the ranks of both the unemployed and employed. The number of unemployed increased by an estimated 179 000 individuals, while the number of employed climbed by 258 000.

Finance, community & social services, and agriculture registered the largest employment gains while job losses were recorded in private households, trade, mining, construction and manufacturing.

At 32,9%, South Africa’s official unemployment rate remains one of the highest in the world.

Tourists begin to return

After a dramatic drop in tourist arrivals in 2020 and 2021, the country experienced a rise in 2022. Just over 10 million tourists graced South African shores in 2019. This crashed to 2,8 million in 2020 and declined further to 2,3 million in 2021. This had a knock-on effect on tourism-related employment, with the sector shedding just over 320 000 jobs in 2020.

Following the pandemic, South Africa welcomed 5,7 million tourists in 2022. This is still way below pre-pandemic levels. However, the latest monthly data shows the positive trend continuing in 2023.

What to look forward to: GDP results out soon

Stats SA will release the latest set of gross domestic product (GDP) figures today (Tuesday, 6 June) at 11:30. These will provide a comprehensive overview of how the economy performed in the first quarter of 2023. So watch this space!

If you want to keep up to date with upcoming releases, see our publication schedule here. For a comprehensive list of products and releases, download our catalogue here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.

Similar articles are available on the Stats SA website and can be accessed here.