Government finances: Social spending jumped in 2020/21

The 254 institutions known as extra-budgetary accounts and funds (EBAs) form an important arm of government. Financial data for 2020/21 (1 April to 31 March) show a sharp rise in EBA spending as government rushed to mitigate the impact of the pandemic. Much of the increase was on social benefits, mainly for the COVID-19 Temporary Employee/Employer Relief Scheme (COVID-19 TERS).

The UIF and the COVID-19 TERS

As a group, EBAs1 spent R301,9 billion in the 2020/21 fiscal year. This represents an increase of R40,8 billion (or 16%) from R261,1 billion in 2019/20. Social benefits expense was the major factor behind the rise in spending, increasing by a notable 106% (R54,6 billion) between 2019/20 and 2020/21 (Figure 1).

The spike in spending on social benefits is almost entirely related to the pandemic – more specifically to the COVID-19 TERS. Announced on 26 March 2020, a day before South Africa’s national lockdown, the COVID-19 TERS was government’s initiative to assist employees who would lose income during the pandemic.2

The Unemployment Insurance Fund (UIF) was the EBA responsible for managing the scheme. Digging deeper into the data, the UIF spent R66,5 billion on social benefits in 2020/21, a significant rise of R57,6 billion from R9,0 billion recorded in 2019/20. Much of this increase was for the COVID-19 TERS. The UIF financed much of the project by drawing from its long-term investments. This had a knock-on effect on the UIF: it earned less interest from its investments, contributing to a decline in its revenue stream for the fiscal year.

While social benefits expense increased in 2020/21, EBAs spent R9,2 billion less on goods and services (Figure 1). The South African National Roads Agency Limited (SANRAL) and the Property Management Trading Entity (PMTE) were the most significant negative contributors. Together, both EBAs reduced spending on goods and services by R2,5 billion, with the pullback mainly due to lockdown regulations disrupting activities related to repairs and maintenance of roads and buildings.

The PMTE and SANRAL were also the biggest drags on overall spending on fixed assets (such as infrastructure, vehicles and buildings). EBA capital expenditure (capex) dropped by R3,7 billion between 2019/20 and 2020/21, with ‘other’ structures and buildings other than dwellings the biggest contributors to the decline (as outlined in Figure 1). Lockdown restrictions and the pandemic’s effect on tendering and procurement processes hindered the activities of PMTE, SANRAL and other EBAs involved in infrastructure development.

Revenue was down across the board

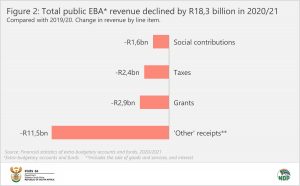

Revenue streams were strained during the COVID-19 pandemic, with EBAs recording a decline of R18,3 billion. The ‘other’ receipts line item – which includes sales of goods & services and interest – accounted for almost two-thirds (R11,5 billion) of the decline (Figure 2).

The three EBAs that made the biggest impact on ‘other’ receipts were the UIF (-R2,1 billion), South African National Parks (SANParks) (-R1,7 billion) and SANRAL (-R1,0 billion). The UIF, as previously mentioned, saw its revenue decline due to a fall in interest earned from its investments.

With far less tourism activity occurring during the lockdown, SANParks recorded a decrease in revenue from accommodation, as well as from conservation fees, Wild Card membership sales, and sales from its filling stations.

SANRAL registered a decline in toll revenue as a consequence of lower traffic volumes during the lockdown period.

Revenue from grants (i.e. monies transferred from other government departments) declined by R2,9 billion. This was mainly due to a decrease in transfers from the Department of Agriculture, Land Reform and Rural Development to the Agriculture Land Holdings Account (‑R1,2 billion), and a pullback in the amount transferred to the National Skills Fund (‑R1,2 billion) from the Department of Higher Education and Training.

EBAs received less income from taxes (-R2,4 billion). This was mainly due to the Road Accident Fund recording a decline in fuel levies (-R2,1 billion). Gambling activity and lottery ticket sales were also down in 2020/21, negatively affecting tax revenue for both the Western Cape Gambling and Racing Board (-R0,2 billion) and the National Lotteries Distribution Trust Fund (‑R0,2 billion).

The data outlined here represent only one arm of government. A more comprehensive picture of the pandemic’s impact in 2020/21 will be revealed as Stats SA publishes financial reports for other spheres of government. The national government report was published on 30 June 20223, and others will follow in the next few months. All the reports will be consolidated into a single document at the end of the year. So watch this space!

For more information, download the Financial statistics of extra-budgetary accounts and funds 2020/2021 report here.

1 EBAs play an important role in delivering services to government or to the public on behalf of government. EBAs mainly rely on government funding, either via financial transfers from national and provincial government or from sales of goods and services to other government institutions. The statistical release contains data for all reporting EBAs within the framework of the Government Finance Statistics Manual, 2014 (GFSM 2014).

2 South African Government, Two-year anniversary of the UIF’s Covid-19 TERS (read here).

3 Stats SA, The impact of COVID-19 on national government finances in the 2020/2021 financial year (read here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.